Ergo, the question of whether a repurchase action is value-enhancing or value-destroying for continuing shareholders is entirely purchase-price dependent… It is puzzling, therefore, that corporate repurchase announcements almost never refer to a price above which repurchases will be eschewed. The same math applies with corporations and their shareholders. If the exiting partner is paid $1,100, however, the continuing partners each suffer a loss of $50. Consider a simple analogy: If there are three equal partners in a business worth $3,000 and one is bought out by the partnership for $900, each of the remaining partners realizes an immediate gain of $50. When that rule is followed, the remaining shares experience an immediate gain in intrinsic value. Here’s Warren Buffett, CEO of Berkshire Hathaway, on what it really means to buy back shares:įor continuing shareholders.repurchases only make sense if the shares are bought at a price below intrinsic value. From March 2016 to March 2017, they spent roughly 14% less than the prior 12-month period.įirst, the reasons to embark on a share buyback program in the first place are debatable.

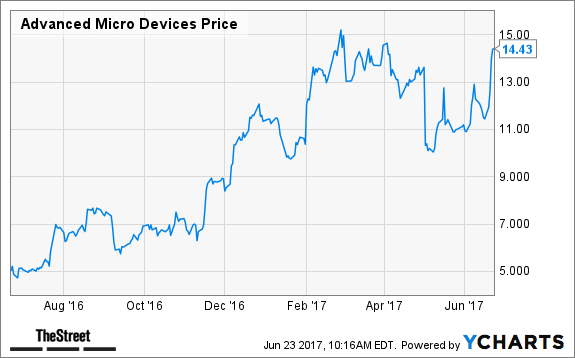

The S&P 500 companies spent 1.6% less in the first quarter of 2017 than they spent in the fourth of 2016 – the quarter immediately prior – and the reasons are myriad. So now that prices are higher, how have companies responded? It looks as though they are pulling back, and we believe that is largely a great development. We have written on the wisdom of buyback programs, in light of hopes of a tax holiday, in light of record cash on balance sheets, and in light of the cheap cost of debt leading companies to load up the balance sheets. When Apple was trading at a P/E of 10, for example, it was much easier to make a case to buy back its shares now that the company trades at almost twice that P/E, the same value is just not there. This includes 9 record closes in a row for the DJIA – a feat that is hard to overlook.As prices on the stock market appreciate, especially for companies like Nvidia ( NASDAQ: NVDA) and Apple ( AAPL), stock prices are inherently less of a good deal than they have been during the economic recovery. In 2017, the Dow Jones Industrial Average, the S&P 500 and the Nasdaq have hit dozens of intraday records.

0 kommentar(er)

0 kommentar(er)